Aerospace & Defense Telemetry Market by Technology (Wired Telemetry and Wireles), Platform (Space, UAVs, Weapons, Airborne, Ground and Marine), Component (Antenna, Processors, Receiver, and Transmitter), and Region (North America, Europe, Asia-Pacific, and Rest of the World) - Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2022-2028

Base Year: 2021

Historical Data: 2016-2020

Market Highlights

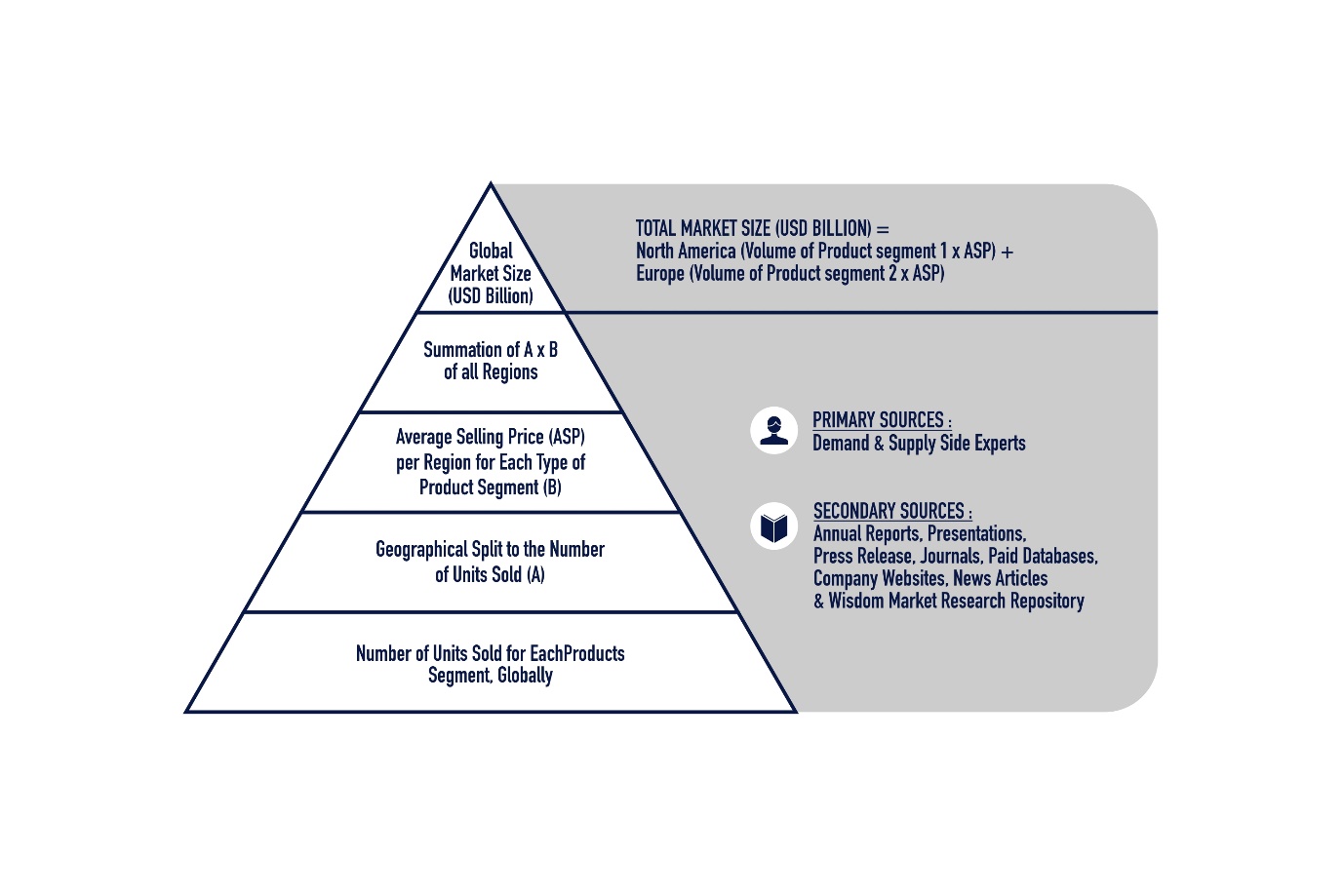

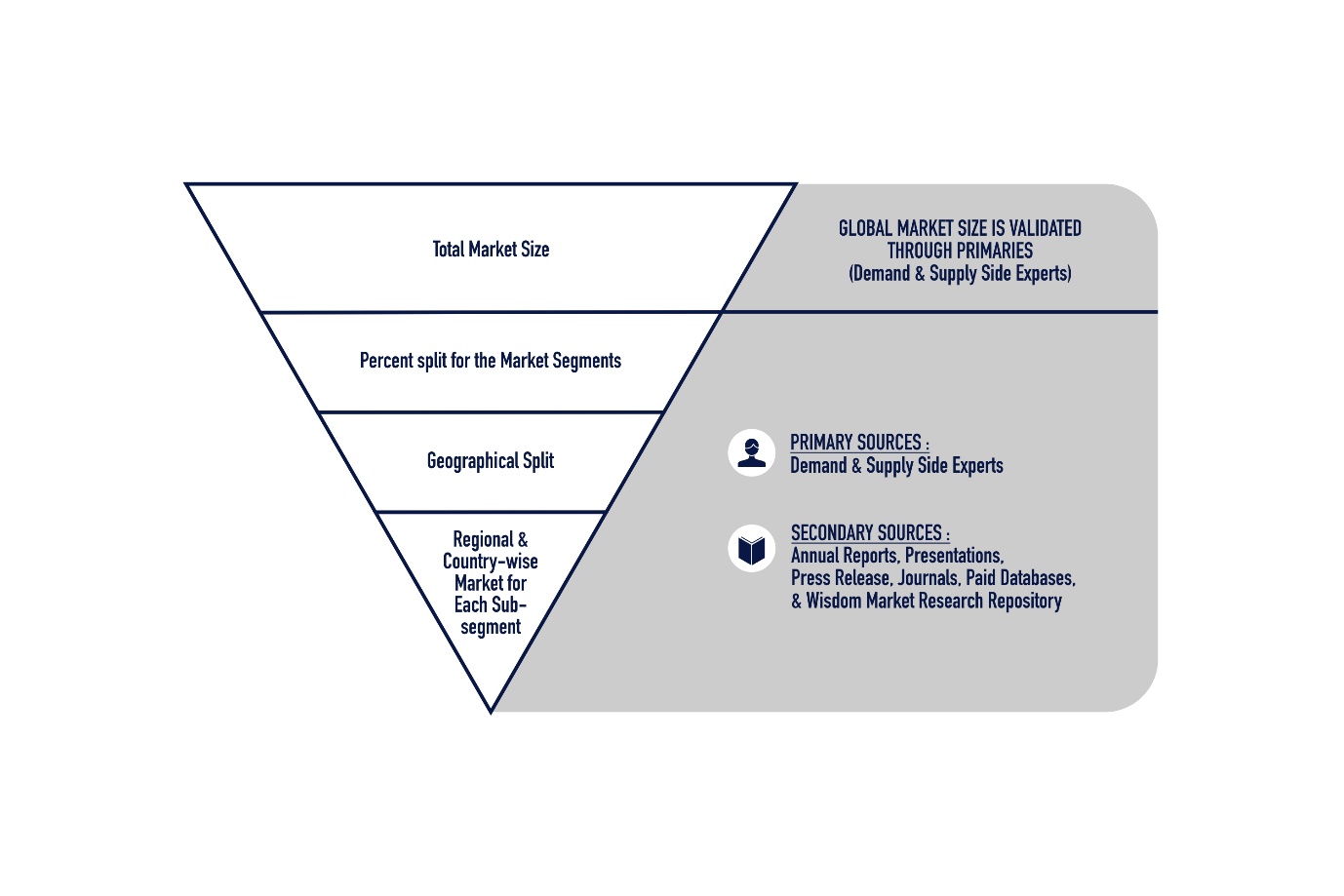

The aerospace and defense telemetry market was valued at US$ 1.4 billion in 2021 and is projected to reach US$ 2.29 billion in 2028, growing at a compound annual growth rate of 7.8% from 2022 to 2028.

Telemetry is the process of automatically measuring and wirelessly transmitting data from distant sources to receiving locations for analysis and observation. Depending on its intended use, this crucial data is sent via a variety of channels, including satellite, GSM, infrared, ultrasonic, and audio. As a result, there is an increasing need for data admittance from remote areas to maintain the federal database of the companies, which helps them make better judgments and save time. The goal of aerospace and defense telemetry is real-time data transfer. In order to enable real-time monitoring of flight ecology conditions, the aeronautical telemetry (ATM) spectrum is essential for aerospace flight testing for both military and commercial uses, such as space exploration, rocketry, and flight testing. The integration of full band telemetry link up into flight test operations was made possible by the WRC bands, and this ultimately contributed to the expansion of the aerospace and defense telemetry business.

The newest antennas are designed as part of airspace development plans to improve airplane communication. For instance, ThinKom Solutions introduced a novel antenna with flexible installation options for special-purpose aircraft in March 2021. An improved Variable Inclination Continuous Transverse Stub (VICTS) antenna designed for government and military use in beyond-line-of-sight (BLoS) circumstances. The product's primary units are currently being incorporated, and formal qualifying is expected to start shortly.

A key focus in nations in Europe and North America is overhauling and changing airspace to improve safety and reduce flight disruptions. The reorganization of airspace has increased effectiveness, boosted pilot communication, and led to better routing choices. In order to effectively communicate with air traffic managers, improve navigation by generating images of forwarding outer scene geography, and accomplish multidimensional aircraft monitoring, new parts and technology must be installed. These airspace transformation plans can reduce carbon emissions, improve air quality, and save fuel when they are carried out effectively. As a result, the modernization and renovation of airspace are having a significant impact on the worldwide market's enormous growth potential.

The need for unmanned aerial vehicles in both the military and commercial sectors, along with the expansion of space exploration programs worldwide, are further factors driving the growth of the global aerospace and defense telemetry market. For instance, NASA, commercial spaceflight businesses in the United States, and international partners like ESA established the ongoing manned spaceflight program known as Artemis. By the end of 2024, the program's main goal is to place "the next man and the first woman" on the moon, specifically in the area surrounding the lunar south pole.

Huge development potential in the global aerospace and defense telemetry market has been driven by several investments made in the telemetry business. Among them are: • Aura elucidates crucial communications linkages to guarantee dependable operations of commercial aircraft operating beyond the apparent line of sight.

Market Segment Analysis

There are two forms of technology: wired and wireless networks. More rapid growth is anticipated in the wireless technology industry because of its cost-effectiveness and platform independence. The architecture industry includes both hardware and software. The growing demand for middleware software in telemetry systems is expected to propel the growth of the software industry. The benefits of wireless technology, like its ease of operation and maintenance, are other factors driving demand for it. A large development opportunity for wireless technology in aerospace and defense telemetry is also facilitated by the strong demand for wireless technology for space shuttles and unmanned aerial vehicles (UAVs).

The platform category includes Airborne, Ground, Marine, Space, Unmanned Aerial Vehicles, and Weapons. In the platform category, ground-based has the biggest aerospace and defense telemetry market share in 2021. The land-based category is expected to grow at the fastest rate; the high share is mostly because to the extensive use of ground-based solutions in developing countries like China and India. Moreover, it is anticipated that during the projected period, the UAVs segment will develop at the fastest rate. The significant demand for UAVs in both military and commercial applications is the primary cause of the UAVs segment's rapid rise. The increasing demand for UAV telemetry systems might be ascribed to the high demand for UAVs due to the necessity of border monitoring.

Geographically speaking, North America is probably going to continue to dominate the aerospace and defense telemetry market for the duration of the projection period. A high rate of telemetry in the aerospace and defense industries is the consequence of rapid modernization and technological breakthroughs in numerous sectors. Tight government restrictions in Western Europe and North America are projected to drive manufacturers to create better defense and aerospace telemetry systems, which is projected to lead to North America's dominance in the aerospace and defense telemetry market over the course of the forecast period.

At the same time, the Asia Pacific aerospace and defense telemetry market is projected to grow at the fastest rate of growth throughout the course of the forecast period. The Asia Pacific aerospace and defense telemetry market is expanding due to the region's main economies placing a strong emphasis on updating their current military equipment. Furthermore, the requirement for technologically advanced defense equipment has grown due to the information age, and the emergence of networked unmanned aerial vehicles (UAVs) used by developing countries for border monitoring is one of the factors driving aerospace and defense telemetry market expansion. However, recent changes to emerging nations' military budgets for state-of-the-art air, land, and maritime defense systems are expected to help the regional aerospace and defense telemetry market.

Key Players

The aerospace and defense telemetry market is highly competitive. The state of the sector and government assistance have a direct impact on the companies' growth. The quality and penetration of these companies' aerospace and defense telemetry in target and growing markets set them apart. Additionally, a few recent large mergers and acquisitions in the sector have had a big impact on the competitive dynamics. As an illustration:

• On November 4, 2020, Saab concluded the first flight tests using its brand-new, extremely advanced Electronic Attack Jammer Pod (EAJP). Additionally, in July 2018, Goonhilly Earth Station (GES) and BAE Systems plc signed an MOU (memorandum of understanding) to supply two Command Processor (TTCP) systems, Telemetry, and Tracking system to Goonhilly Earth Station. In October 2020, BAE Systems was awarded a contract worth USD$36.7 million by the US Navy to develop and test a new dual-band Fiber-Optic Towed Decoy (FOTD) to shield pilots and aircraft from advanced threats. Future robotic and manned missions to Mars and the Moon will be able to be tracked and communicated with by GES thanks to this technology.

Market participants' investments and efforts in developing new products have had an impact on the competitive environment as a whole. The leading companies in the aerospace and defense telemetry market are as follows:

The following American companies: Honeywell International Inc. (U.S.); L3harris Technologies (U.S.); Lockheed Martin (U.S.); BAE Systems PLC (U.S.); General Dynamics Corporation (U.S.); Maxar Technologies (U.S.).

Aerospace & Defense Telemetry Market Scope:

| Report Data | Aerospace & Defense Telemetry Market |

| Aerospace & Defense Telemetry Market Forecast Value 2028 | 2.29Billion |

| Aerospace & Defense Telemetry Market CAGR 2022 - 2028 | 7.8% |

| Aerospace & Defense Telemetry Market Forecast Period | 2022 - 2028 |

| Aerospace & Defense Telemetry Market Base Year | 2021 |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

| Key Companies Profiled | Honeywell International Inc. (U.S.); L3harris Technologies (U.S.); Lockheed Martin (U.S.); BAE Systems PLC (U.S.); General Dynamics Corporation (U.S.); Maxar Technologies (U.S.).. |

| Key Segments | By Technology By Platform By Component By Region |

| Report Coverage | Market Sizing, Market Forecasting, Market Dynamics, Market Trends, Market Development Analysis, Market Share Analysis, Regional Analysis, Competitive Positioning, Competitive Benchmarking, Competitive Landscape, Company Profiling, Regulation Analysis, etc. |

Get Your Report Customized

Further segmentation of the market on the basis of type, application, end use, product, technology, method, process and any other segment depending on the market

Segmentation on the basis of any specific country or region

Any segment can be classified on the basis of application

Application segment can be further divided on the basis of companies

The companies profiled are not limited, we can incorporate additional companies of your choice

We can split the company market share on the basis of product, application and region

Report can be prepared for any specific country/region/segment

Customers can be added on the basis of regions and countries

Choose License Type

Get in touch with us

Why choose us

Proactive

We manage our resources 24/7 to identify issues and address them before they become problems

Quality & Reliability

We are committed to providing reliable and highly accurate data with an excellent quality control system

Global Outreach

6 Major regions and 40+ countries level analysis accomplished

Competitive Pricing

Our pricing strategy is highly competitive in the market, without compensating on the quality and the timeline of project delivery

Aerospace & Defense Telemetry Market

Published Date : Jan 2022 | Formats :

UP TO 30 % OFF

Single User License

10% OFF

Team License

15% OFF

Corporate License

30% OFF

Book before: 31st May 2024

Some Facts About The Research Intellica

800+

Reports Published Per Year

2500+

Consulting Projects till date

125+

Fortune 500 Clients

1600+

Analysts and Contract Consultants