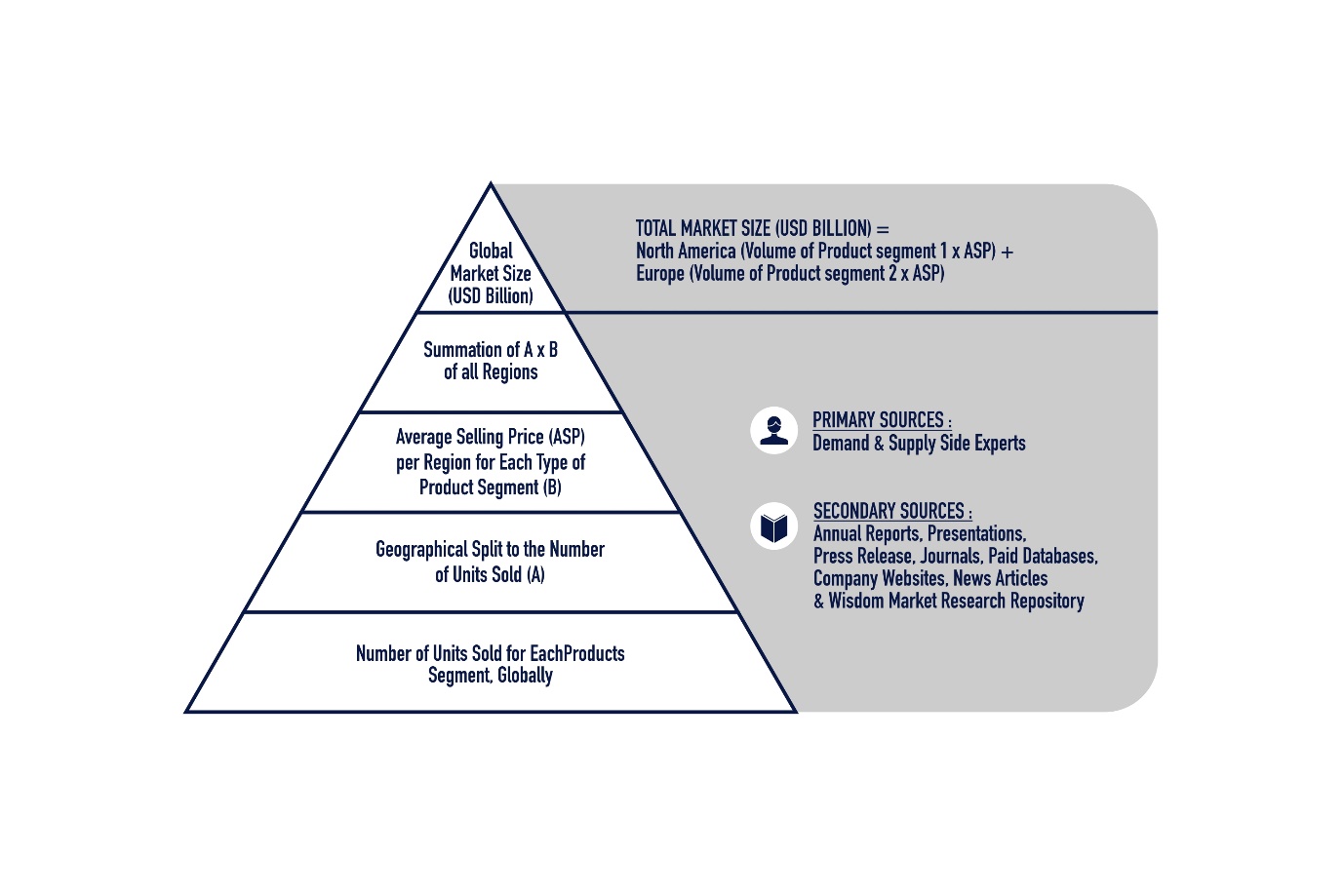

Infrared and Thermal Imaging Systems Market by Form Factor (Fixed & Mounted and Handheld), Solution (Services, Software and Hardware), Technology (Cooled and Un-Cooled, Others), and Application (Construction, Maritime, Military, Security & Surveillance, Transportation, and Others), and Region - Market Size, Share, Trend, Forecast, Competitive Analysis, and Future Outlook: 2022-2028

Base Year: 2021

Historical Data: 2016-2020

Market Highlights

A compound annual growth rate (CAGR) of 8.8% is predicted for the global infrared and thermal imaging systems market, which was valued at US$ 3.1 billion in 2021 and is projected to reach US$ ~6.2 billion in 2028.

The worldwide market for infrared (IR) and thermal imaging equipment is growing rapidly as a result of many military applications. When there is no ambient light, systems that use infrared and thermal imaging can locate objects and people in the dark. In addition, infrared and thermal imaging equipment can provide high-resolution images in real time through the penetration of smoke, fog, and haze. Even in extremely cold conditions, infrared and thermal imaging devices use modern technology to detect heat or infrared signals. Furthermore, a variety of uses for infrared and thermal imaging systems exist, such as remote sensing, space imaging, and surveillance.

The government had imposed a lockdown in an effort to limit the spread of COVID-19, forcing manufacturers of infrared and thermal imaging systems to suspend production. The government's response to the COVID-19 pandemic has caused a disruption in the supply chain, which has delayed the purchase of infrared and thermal imaging systems by military agencies. The COVID-19 pandemic has caused governments worldwide to prioritize healthcare services, placing a financial strain on military organizations. The development of infrared and thermal imaging systems is negatively impacted by the labor shortage resulting from the travel restrictions imposed by nations worldwide to curb the spread of COVID-19.

Initially, the military and the defense sector used infrared and thermal imaging equipment. The increased expenditure on surveillance by the military industry is expected to drive future growth in the deployment of infrared and thermal imaging systems. Governments from all around the world are investing funds to provide military troops with better and more accurate information through the upgrading of next-generation technology. The expansion of infrared cameras, especially short-wavelength ones, has been influenced by the increasing use of IR thermography equipment in the military industry. Around the globe, there is an increase in both criminal activity and violence. As a result, the homeland security forces now have more money to buy state-of-the-art technology and protective systems. The availability of more lethal and non-lethal weapons has made modern warfare more asymmetrical.

The need for high-definition thermal imaging technology, military modernization programs, and increased military spending are the main factors propelling the global infrared and thermal imaging systems market. The market's growth is however constrained by high equipment costs and stringent rules on technology transfer. On the other hand, new opportunities for the industry include the use of thermal scanners at airports, geospatial analysis, and the incorporation of artificial intelligence into imaging systems.

Most companies are keen to develop an improved infrared camera that can provide complete infrared data in order to gain a competitive edge over competitors. A high-speed infrared camera with a maximum data throughput of more than one gigapixel, for example, was introduced by Telops. The infrared camera has a maximum frame rate of 90,000 frames per second in sub-window mode (64 × 4 pixels) and 1900 frames per second in full resolution. Autonomous car adoption has been very robust in Canada. Furthermore, Pittsburgh, Pennsylvania, and Phoenix, Arizona have been the sites of driverless technology tests conducted by companies such as Uber.

The industry has received a number of directives and investments in recent years that should expand the market as a whole. Among them are:

• Military organizations are investing in soldier-carried sensor technology to achieve battlefield combat dominance. A 20.6 million USD contract has been awarded by the US Army to FLIR System Inc., a thermal imaging systems manufacturer based in Oregon, to supply the Black Hornet 3 nano UAV, a personal reconnaissance system. Black Hornet uses fused thermal imaging, which blends visible and thermal images for better surveillance. In addition, it can fly for 25 minutes and gives the operator live footage. Such investments in thermal military weaponry will propel the global infrared and thermal imaging systems market.

• Thermal imaging technology enables all-weather, day-and-night surveillance and imaging systems. FLIR Systems Inc. has announced the 2020 release of Ranger HDC MR, a new high-definition mid-range surveillance system that uses medium-wave infrared. (MWIR). The Ranger HDC MR is a high-performance HD thermal imaging device that can see through air turbulence, heat, haze, and fog thanks to its 1280 by 720 pixel detector. Additionally, border surveillance to search for illegal cross-border activity and counter-UAV measures will make use of this high-definition infrared and thermal imaging equipment. These developments in high-definition thermal imaging technologies are expected to fuel growth in the global infrared and thermal imaging systems market.

Market Segment Analysis

Based on technology, industry, applications, geography, and country, this study divides the global market into segments. Based on technology, the market is divided into two segments: infrared and thermal imaging systems, which are cooled and uncooled. Based on the form factor, the market is further divided into the portable and fixed & mounted markets. Applications such as transportation, security and surveillance, thermography, military vehicle vision, soldier portable vision, unmanned vehicles, and others can be categorized within this market.

The study covers the following regions: North America, Europe, Asia-Pacific, the Middle East, and Latin America. Furthermore, the Asia-Pacific region offers opportunities for future growth because to its high defense spending, increasing technological adoption, and plenty of small and medium-sized enterprises (SMEs).

Key Players

The global Infrared and thermal imaging systems market face intense competition. The state of the industry and government assistance have a direct impact on the companies' growth. Based on their quality and market penetration in both target and emerging markets, these companies set themselves apart with their infrared and thermal imaging equipment. Furthermore, the competitive dynamics in the industry have been greatly impacted by a few recent large mergers and acquisitions. As an illustration:

• Seek Thermal unveiled the latest personal thermal imaging camera (TIC) for firefighters, the Reveal FirePro X, in April 2021. The enhanced portable thermal imaging camera is now more reliable and practical to use thanks to a revised charging connector.

• The FLIR Boson-based thermal camera, which is comparable to the FLIR Thermal Automotive Development Kit, was first offered as an option on the brand-new Cadillac Escalade (ADK) in February 2021 as part of Veoneer's fourth-generation Night Vision System. The new thermal-vision system has four times the resolution and a broader field of view than the previous generation, which increases road coverage, improves situational awareness, and provides the driver with a clearer image.

• June 2021: Collins Aerospace, Pratt & Whitney, and the Raytheon Technologies Research Center are working together to develop power and thermal management technologies that will facilitate upgrades to the current fleet and enable military aircraft in the future.

• Opgal Optronic Industries Ltd. debuted the EyeCGas Mini in April 2021. Its goal is to locate medium-sized to large leaks. HFCs, methane, SF6, and ammonia are examples of other gases. This compact, reasonably priced infrared camera will make leak detection and repair (LDAR) equipment more accessible to a larger number of people.

These mergers and acquisitions have had an impact on the competitive landscape as a whole. The infrared and thermal imaging systems market is dominated by the following companies:

HT Italia S.r.l., Bullard GmbH, Seek Thermal Inc., Trijicon Inc., Raytheon Co., Fluke Corporation, Flur Systems Inc., Opgal Optronic Industries Ltd, Testo Inc.

Infrared and Thermal Imaging Systems Market Scope:

| Report Data | Infrared and Thermal Imaging Systems Market |

| Infrared and Thermal Imaging Systems Market Forecast Value 2028 | 6.2Billion |

| Infrared and Thermal Imaging Systems Market CAGR 2022 - 2028 | 8.8% |

| Infrared and Thermal Imaging Systems Market Forecast Period | 2022 - 2028 |

| Infrared and Thermal Imaging Systems Market Base Year | 2021 |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

| Key Companies Profiled | HT Italia S.r.l., Bullard GmbH, Seek Thermal Inc., Trijicon Inc., Raytheon Co., Fluke Corporation, Flur Systems Inc., Opgal Optronic Industries Ltd, Testo Inc.. |

| Key Segments | By Form Factor By Solution By Technology By Region |

| Report Coverage | Market Sizing, Market Forecasting, Market Dynamics, Market Trends, Market Development Analysis, Market Share Analysis, Regional Analysis, Competitive Positioning, Competitive Benchmarking, Competitive Landscape, Company Profiling, Regulation Analysis, etc. |

Get Your Report Customized

Further segmentation of the market on the basis of type, application, end use, product, technology, method, process and any other segment depending on the market

Segmentation on the basis of any specific country or region

Any segment can be classified on the basis of application

Application segment can be further divided on the basis of companies

The companies profiled are not limited, we can incorporate additional companies of your choice

We can split the company market share on the basis of product, application and region

Report can be prepared for any specific country/region/segment

Customers can be added on the basis of regions and countries

Choose License Type

Get in touch with us

Why choose us

Proactive

We manage our resources 24/7 to identify issues and address them before they become problems

Quality & Reliability

We are committed to providing reliable and highly accurate data with an excellent quality control system

Global Outreach

6 Major regions and 40+ countries level analysis accomplished

Competitive Pricing

Our pricing strategy is highly competitive in the market, without compensating on the quality and the timeline of project delivery

Infrared and Thermal Imaging Systems Market

Published Date : Feb 2021 | Formats :

UP TO 30 % OFF

Single User License

10% OFF

Team License

15% OFF

Corporate License

30% OFF

Book before: 31st May 2024

Some Facts About The Research Intellica

800+

Reports Published Per Year

2500+

Consulting Projects till date

125+

Fortune 500 Clients

1600+

Analysts and Contract Consultants