Mechanical Control Cables Market by End Users (Military & Defense and Internal Security), Types (Arial and Ground-based ) and Region - Market Size, Share, Trend, Forecast, Competitive Analysis, and Future Outlook: 2022-2028

Base Year: 2021

Historical Data: 2016-2020

Market Highlights

A compound annual growth rate (CAGR) of 5.9% is predicted for the mechanical control cables market, which was valued at US$ 10.2 billion in 2021 and is projected to reach US$ ~12.6 billion in 2028.

The worldwide mechanical control cables market is benefiting greatly from the expanding fleet of commercial aircraft. Mechanical control cables push or pull to activate mechanical functions. A range of fittings, such as connecting pins, throttle arms, grips, forks, spring mounts, and eyes, round off the mechanical control cables. Two more names for mechanical control cables, depending on the action they employ, are push-pull and pull-pull. Push-pull mechanical control cables are used in hydraulic, pneumatic, and electrical systems, as opposed to pull-pull mechanical control cables, which are used in applications such as position adjustment where tension is required for the transmission force.

Mechanical control cables are those that provide a push-pull or other mechanism to mechanically activate components. They consist of a mechanical cable that is attached to fittings such as handles, forks, studs, and eyes. Depending on the kind of motion being employed, mechanical control cables are also known as push-pull or pull-pull control cables. Mechanical control cables are available for push-pull or pull-pull applications. In the instance of push-pull mechanical control cables, compression pushes motion in one direction while tension pulls it in another. Push-pull mechanical control cables can be used in place of electrical, hydraulic, and pneumatic control systems. Pull-pull mechanical control cables exert force in one direction through tension, and reverse the control's motion using spring actuation.

The COVID-19 outbreak and the government-imposed shutdown have led to a halt in operations for manufacturers of mechanical control cables. Automakers are facing short-term operational issues as a result of supply chain disruptions brought on by government measures to limit the spread of COVID-19. As a result of government-imposed travel restrictions aimed at containing the COVID-19 pandemic, mechanical control cable manufacturing companies are forced to halt existing product development projects due to a lack of staff.

In addition, the aviation industry faces a shortage of raw materials and tools. The travel limitations implemented globally to contain the COVID-19 pandemic are causing airlines to incur losses as a result of having to pay for maintenance services without getting paid for them.

Recent years have seen a number of directives and investments in the sector that should expand the mechanical control cables market as a whole. Among them are: • Mechanical control cables are needed for aircraft landing gears and flight control systems. Furthermore, for precise control, the mechanical control cable used in airplanes must have little backlash and great mechanical efficiency. Airbus has published a worldwide aircraft market prediction predicting the requirement for over 39,000 extra aircraft over the next 20 years to satisfy the predicted 4.3 percent annual growth in air traffic. A rise in air travel will raise the demand for commercial aircraft in nations where the aviation industry is predicted to grow in the coming years. This growth in the aviation industry is expected to have a positive impact on the mechanical control cables market.

• A few of the numerous tasks performed by mechanical control systems in automobiles include clutch management, drive management, brake engagement, power take-off management, engine choke, and speed selection. Military vehicles require robust mechanical control wires in order to be driven precisely and efficiently in difficult external situations. In 2018, the US Army awarded a contract to General Dynamics Land Systems, a military vehicle manufacturing division of General Dynamics with its headquarters located in Michigan, for the upgrade and modification of 116 IAV Stryker vehicles, which are eight-wheeled armored fighting vehicles. The contract was for approximately 258 million USD. These kinds of investments in military vehicles will increase the demand for mechanical control cables.

Market Segment Analysis

According to predictions, the wire material segment will have the highest compound annual growth rate (CAGR) in the mechanical control cables market for aerospace and defense in 2020. Copper or aluminum wires may have one conductor or several non-insulated conductors. A range of materials and layers are utilized to insulate the flexible stranded conductors used in aviation wires to provide heat protection, abrasion resistance, moisture resistance, and fluid resistance. A range of mechanical cables are needed for applications requiring landing gear, engine control, flight control, and auxiliary control.

End-user projections indicate that in 2020, the commercial segment is expected to hold the largest market share. It is projected that modernization and maintenance programs, along with a rise in the number of new commercial aircraft deliveries in the Asia Pacific region, will propel the commercial end-use mechanical control cables market. The fleet of commercial aircraft is expanding in tandem with the growth of air travel. This is expected to stimulate the mechanical control cable aftermarket. According to Boeing's Commercial Market Outlook 2019, there will be 50,660 operational commercial aircraft by 2038, up from 25,830 in 2018. This increase in fleet is expected to be a major factor driving the growth of the mechanical control cable aftermarket.

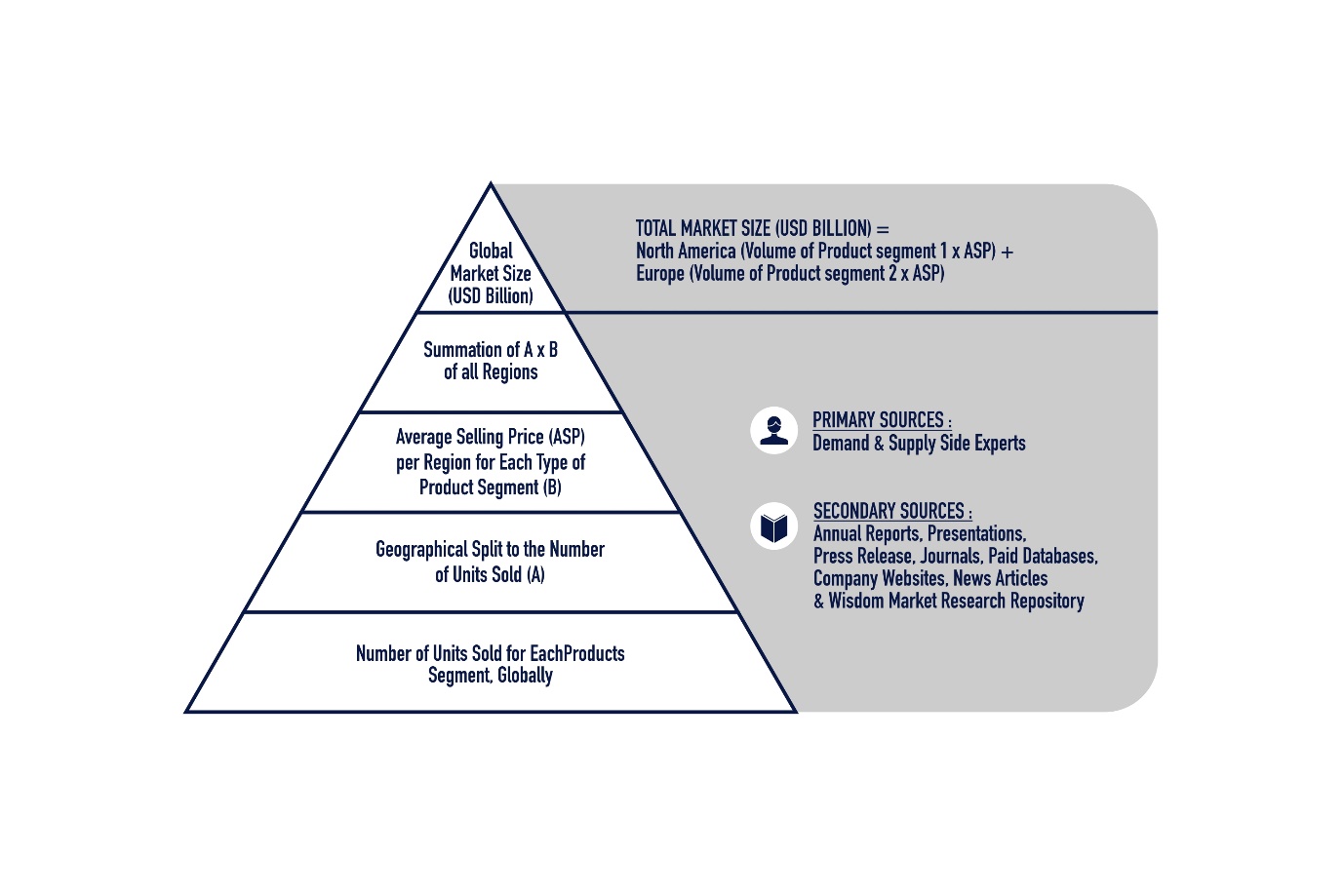

Geographically, the largest mechanical control cables market share in 2020 was held by North America. North America has a substantial potential market for mechanical control cables used in aerospace and the armed forces. North America might be seen as a mature market because the majority of the enhancements made here are intended to enhance the infrastructure that already exists, such as the army and navy's acquisition of armored vehicles. SIPRI's Trends in World Military Expenditure Database shows that in 2019, the US alone accounted for 36% of all military spending worldwide. The offshore industry in the country offers attractive economic opportunities for foreign shipbuilding companies. Therefore, the growth of the US shipbuilding industry is one of the key factors that will support the mechanical control cables market for mechanical components associated to shipbuilding. This demand will fuel the mechanical control cables market globally.

Key Players

In the mechanical control cables market, there is fierce competition. The state of the sector and government assistance have a direct impact on the companies' growth. The quality and market penetration of these firms' mechanical control cables allow them to stand out in both target and emerging markets. Additionally, a few recent large mergers and acquisitions in the sector have had a big impact on the competitive dynamics. As an illustration:

• Mechanical control cables are subject to a number of military regulations, including MIL-DTL 83420L, 87161F, 18375H, 87218D, and 83140A. The Douglas Material Specifications (DMS) 2187 and 2192 and the Boeing Material Specifications (BMS) 7-265 are examples of private specifications for mechanical control cables. Many additional specifications are met by mechanical control wires. Some of the criteria that need to be taken into account are the mechanical control cables' maximum push-pull loads, length, and thickness.

These mergers and acquisitions have had an impact on the competitive landscape as a whole. Major participants in the mechanical control cables market include the following:

Elliott Manufacturing; AeroControlex, Orscheln Products, Glassmaster Controls Company, Inc.; Loos & Co. Inc.; Crane Aerospace & Electronics; Triumph Group; Escadean Ltd.; Silva Group; Bergen Cable Technology, Inc.; Cable Manufacturing & Assembly, Inc.; Wescon Controls; Tyler Madison, Inc.; Drallim Industries Limited; Grand Rapids Controls, LLC.; Cablecraft Motion Controls; Ringspann GmbH; Lexco Cable Mfg.; VPS Control Systems, Inc.

Mechanical Control Cables Market Scope:

| Report Data | Mechanical Control Cables Market |

| Mechanical Control Cables Market Forecast Value 2028 | 12.6Billion |

| Mechanical Control Cables Market CAGR 2022 - 2028 | 5.9% |

| Mechanical Control Cables Market Forecast Period | 2022 - 2028 |

| Mechanical Control Cables Market Base Year | 2021 |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

| Key Companies Profiled | Elliott Manufacturing; AeroControlex, Orscheln Products, Glassmaster Controls Company, Inc.; Loos & Co. Inc.; Crane Aerospace & Electronics; Triumph Group; Escadean Ltd.; Silva Group; Bergen Cable Technology, Inc.; Cable Manufacturing & Assembly, Inc.; Wescon Controls; Tyler Madison, Inc.; Drallim Industries Limited; Grand Rapids Controls, LLC.; Cablecraft Motion Controls; Ringspann GmbH; Lexco Cable Mfg.; VPS Control Systems, Inc.. |

| Key Segments | By End User By Type By Region |

| Report Coverage | Market Sizing, Market Forecasting, Market Dynamics, Market Trends, Market Development Analysis, Market Share Analysis, Regional Analysis, Competitive Positioning, Competitive Benchmarking, Competitive Landscape, Company Profiling, Regulation Analysis, etc. |

Get Your Report Customized

Further segmentation of the market on the basis of type, application, end use, product, technology, method, process and any other segment depending on the market

Segmentation on the basis of any specific country or region

Any segment can be classified on the basis of application

Application segment can be further divided on the basis of companies

The companies profiled are not limited, we can incorporate additional companies of your choice

We can split the company market share on the basis of product, application and region

Report can be prepared for any specific country/region/segment

Customers can be added on the basis of regions and countries

Choose License Type

Get in touch with us

Why choose us

Proactive

We manage our resources 24/7 to identify issues and address them before they become problems

Quality & Reliability

We are committed to providing reliable and highly accurate data with an excellent quality control system

Global Outreach

6 Major regions and 40+ countries level analysis accomplished

Competitive Pricing

Our pricing strategy is highly competitive in the market, without compensating on the quality and the timeline of project delivery

Mechanical Control Cables Market

Published Date : Aug 2021 | Formats :

UP TO 30 % OFF

Single User License

10% OFF

Team License

15% OFF

Corporate License

30% OFF

Book before: 31st May 2024

Some Facts About The Research Intellica

800+

Reports Published Per Year

2500+

Consulting Projects till date

125+

Fortune 500 Clients

1600+

Analysts and Contract Consultants